It would be inappropriate to criticize equitable owner-manufacturer partnerships; however, there is still a need to become more aware of the hidden, long-term adverse effects of one-sided partnerships or alliances. That said, the purpose of this article is twofold: One is to steer readers away from one-sided partnerships or vendor alliances. The second is to explain why global single-source procurement strategies for reliability-critical components rarely (if ever) meet a buyer’s overall objectives and expectations.

The decision to single-source reliability-critical components often has unforeseen consequences and is decidedly not made with employee training in mind. Global purchasing of mechanical seals can stifle the incentive for the global partner’s competitors to call on you in the future. You then no longer have access to and are no longer acquiring an understanding of innovative products. It is those innovative products which can greatly benefit modern user plants. Once a plant shuts out all but one component supplier, other contenders will usually abandon their valuable teaching and mentoring roles. When that happens, the purchaser ends up on the losing end of an inevitable chain of events.

SINGLE-SOURCING AND ITS UNINTENDED CONSEQUENCES

There can be significant drawbacks to the highly publicized global supplier agreements which supply chain experts now often advocate. Years ago, such drawbacks were recognized by an organization starting up a large “grass roots” olefins plant. The owners had initially asked the EPC (engineering and procurement contractor) to purchase mechanical seals exclusively from winning bidder “A”—a well-known worldwide supplier. Although starting up with 100 percent of these parts being supplied by Vendor “A”, compelling reasons to add “B” and “C” became evident very soon after plant startup. As matters stand today, decades later and after certain disappointments with “A”, that vendor’s products are still installed in 75 to 80 percent of the process pumps at this plant.

Yet, the other 20 to 25 percent of the facility’s mechanical seals have long since been divided up by manufacturers “B” and “C.” All three vendors compete well and are eager to conduct periodic technology update briefings for the olefin plant’s engineers and operating technicians. Due to moves toward global procurement it is not unusual to find owner-user facilities with only one—solidly entrenched—seal vendor. Because they are the designated supplier, single-source vendors often see no incentive to alert their customers to superior solutions offered by others.

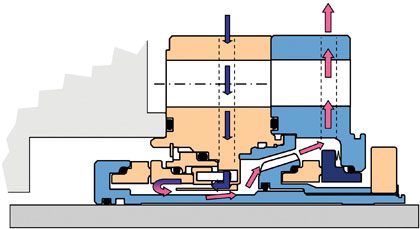

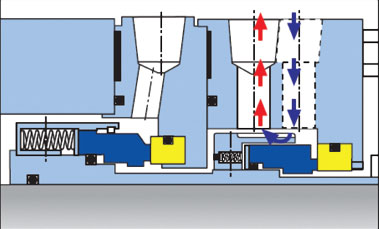

To illustrate: Only Vendor “C” makes the tapered pumping ring in figure 1. This proprietary component opens up interesting solutions for moving fluid from the smaller of the tapered ring’s two diameters to the larger one. Efficient flow movement is accomplished by its impeller-like geometry with large clearance between this rotating part and the surrounding stationary seal parts. Careful examination of the more traditional pumping rings offered by “A” and “B” (figure 2) may disclose much narrower clearances and H/Q (head vs. flow) characteristics less desirable than those of figure 1. Chances are that preferred vendor “A” never shares this information with any of its locked-in clients.

Figure 1: A highly effective tapered, bi-directional, pumping ring (Innovative Vendor).

MAKING ALLIANCES MUTUALLY BENEFICIAL

As mentioned earlier, not all mechanical seal supplier agreements benefit both parties equally and some rather one-sided alliances exist. At a pump users’ conference the suggestion was made that the supposed “seal alliance partner” should disclose pumping services where another manufacturer’s seal would outperform the partner’s products. One seal manufacturer participating at the conference disparaged the suggestion; another vendor simply said they had no comment.

Fortunately, there is at least one well-known major manufacturer with experience in what we really need: sealing products that represent best life-cycle cost value. And, of course, the application of sealing products which represent best long-term value is the only approach that makes sense, regardless of whether these products are

- Already in your plant and originally supplied by one of the alliance partner’s competitors,

- Supplied by your alliance partner company and installed in your plant at the next downtime event, or

- Supplied by one of the alliance partner’s competitors and installed in your plant during the next downtime event.

Note also that a knowledgeable partner supplier will often point out substantial and valuable pump improvement opportunities. The implementation credits for these measures will not only outlive seal life, but will drive up equipment MTBR/MTBF (mean-time-between-repairs/mean-time-between-failures) as well. Valuable maintenance cost savings will result from such cooperative communications.

For an agreement to meet the test of mutual benefit, achieving at least 90 percent of the seal life obtained elsewhere for a given service should be one of the stipulated goals. Since energy efficiency, regulatory compliance and effective supply chain management are part of the life-cycle cost objectives, the use of (dry) gas seals, and perhaps even seals manufactured by the competition, cannot be ruled out. Since the partners must share data on best available sealing technology, the supplier must compile and disclose this technology to the user. User and supplier will then have joint access to all available data and can track their combined achievements against best available technology.

The supplier should benefit from a base fee paid and should, in addition, earn a success fee that gradually peaks at achieving the 90 percent mark mentioned above. Additional bonuses may be negotiated and pre-defined as the 90 percent mark is exceeded.

Figure 2: Cog-style pumping rings associated with relatively inefficient flowrate and heat removal capability (Vendor “B”).

DEFINE THE SCOPE OF SUPPLY AND STIPULATE BUY-BACK PROVISION

The supplier should agree to furnish products and services including

- Mechanical seal hardware (complete seals and components) and/or the repair of same for a given population of rotating equipment as defined in an appropriate tabulation that will have to be appended to the narrated agreement.

- Detailed and specific instructions, assessments, life-cycle cost impact calculations (including energy efficiency) and other recommendations, as needed for enhancing the reliability of all sealing systems predefined and covered by the agreement.

- Training of operators and maintenance workforces on a predefined time schedule. Unless otherwise agreed, training is to be conducted quarterly.

- An on-site technician is to be supplied. This technician should spend a specified number of man-hours per year at the user’s facility.

- Management of the supply chain of the inventory of complete seals, the rebuilding of seals (regardless of origin), without jeopardizing the availability of equipment within the population to meet the plant production requirements.

Conceivably, the supplier should purchase the current and useable mechanical seal inventory from the user—subject to the following conditions:

- The inventory must be utilized on equipment currently in use and expected to be in use over the term of the contract.

- The inventory must be of current design and suitable for providing reliability commensurate with the goals set forth in this agreement.

- The inventory meeting the above criteria should be acquired by the supplier at an agreed discount on its present book value.

- The inventory should be paid for in the form of a credit memo to be used to offset the base fees to be paid to the supplier. The credit memo should not exceed a defined share of the base fee in any given month over the life of the contract.

- Any inventory purchased by the supplier that has not been used in fulfilling this contract should be repurchased by the plant owner at the termination or completion of this contract. Repurchase should be at the same price as paid by the supplier, plus carrying costs of the unused inventory at 10 percent per year.

A LOOK AHEAD

Although it is not our intention to prescribe iron-clad stipulations or the exact wording one must use, all mature owner-manufacturer relationships are anchored in communication, cooperation, and consideration. In the second part of this article, we’ll lay out our suggestions for the roadmap to optimized seal selection, which will include common-sense obligations and responsibilities for equitable owner-manufacturer partnerships as well guidelines for oversight, compensation, and other terms.

About The Author

Heinz P. Bloch, P.E., is one of the world’s most recognized experts in machine reliability and has served as a founding member of the board of the Texas A&M University’s International Pump Users’ Symposium. He is a Life Fellow of the ASME, in addition to having maintained his registration as a Professional Engineer in both New Jersey and Texas for several straight decades. As a consultant, Mr. Bloch is world-renowned and value-adding. He can be contacted at heinzpbloch@gmail.com.

MODERN PUMPING TODAY, February 2015

Did you enjoy this article?

Subscribe to the FREE Digital Edition of Modern Pumping Today Magazine!