For many industrial concerns, the cost of lease commitments that currently don’t sit on the balance sheet can be upwards of 62 percent of existing balance sheets. The new lease accounting standards (ASC 842 and IFRS 16) come into force at the start of next year, fundamentally changing how companies account for leases. It can move thousands of leases onto a company’s books and requires CFOs to apply accounting judgment across thousands of leases. Ross Chapman and Jeremy Suddards, of global financial software specialist Aptitude Software, share their insights on what these changes can mean.

MPT: What do you foresee the effects of the new lease accounting standards to be for most international companies?

Ross Chapman: Many investors, CEOs, and business managers are on course to hit the unforeseen impacts of new lease accounting rules. The financial effects of the new rules are largely unknown as most companies have yet to implement systems that can deliver control and transparency over lease accounting.

Although the new standard can be summarized in just over twenty pages, it is deceptively complex. A very high level of judgment and consideration is needed to apply accounting consistently and appropriately across a diverse range of leasing arrangements. Although often out of sight, leased assets can be equivalent to an enormous proportion of a company’s value.

Jeremy Suddards: The new leasing standards are an accounting nightmare. A global technology brand recently approached us with over $2 billion of operating leases. Applying the new accounting standard was going to have a huge impact on their business and they needed to understand exactly how new rules would affect their financial position.

MPT: And what did you discover?

Jeremy Suddards: After a series of mergers and acquisitions, that technology business has multiple ledgers and numerous different lease management systems. With over fifty entities around the world, the combination of multiple currencies, embedded equipment leases, and other complex arrangements made achieving compliance and gaining control of lease accounting a priority.

MPT: Will the new standard effect everyone the same?

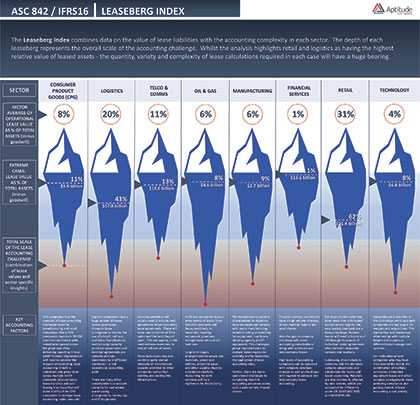

Ross Chapman: Some leading multi-nationals have realized that they were on course to hit a “leaseberg” and have mobilized their teams to achieve compliance with new lease accounting capabilities. Many others, unfortunately, have not realized the real-world accounting challenges required to achieve compliance and gain control over the lease liabilities that will need to be managed on their balance sheets.

Jeremy Suddards: Aptitude’s “Leaseberg Index” shows how the overall challenge differs across these sectors and combines industry specific insights with data on the value of leases. It’s reviewable on our website, www.aptitudesoftware.com.

_______________________________________________________

MODERN PUMPING TODAY, March 2018

Did you enjoy this article?

Subscribe to the FREE Digital Edition of Modern Pumping Today Magazine!

![]()