By Lowell Ungar and Andrew Whitlock, ACEEE

In part 1 of this series, we introduced how sustainability and financial reports are communicating the role of energy efficiency in sustainability initiatives. Below, we will conclude with an analysis of corporate sustainability reports for thirty large companies. We will also note key sources of information on targets and reports and conclude with recommendations for how companies could make better use of efficiency as a corporate sustainability measure.

Every company can increase the energy efficiency of its operations, whether by improving the efficiency of its offices and equipment or by optimizing its manufacturing energy usage. The approach will be unique to the industry and company.

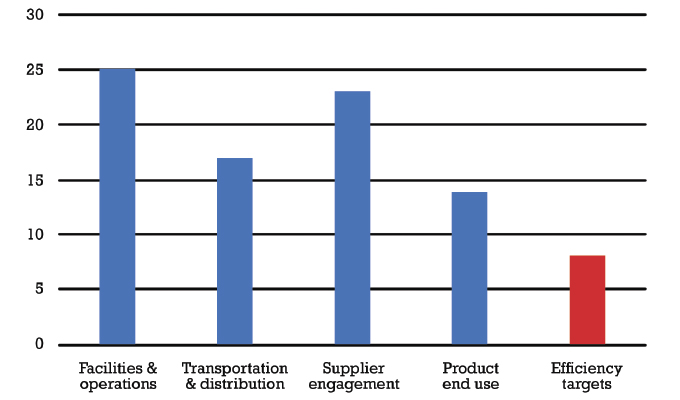

FACILITIES AND OPERATIONS

Some companies highlight specific efficiency projects that they have implemented at a facility or business unit. For example, Hewlett Packard recognizes its Palo Alto site, where it completed major efficiency upgrades. This site was able to reduce its electricity usage by 8 percent and save over $150,000 with building automation system upgrades, retro-commissioning projects, and new LED lighting and controls. General Mills completed sixty energy efficiency projects in fiscal year 2018 focusing on compressed air, lighting, and steam/hot water.

These projects saved over 12 million kWh, $4.8 million, and GHG emissions equivalent to 6,000 metric tons of CO2 (MT CO2e). Alcoa specifically mentions the approaches it uses to minimize process energy consumption of its smelters and cast houses, such as the SMART manufacturing platform and oxy-fuel burners.

Companies also report using strategic energy management and energy management software systems to achieve operational energy savings at their facilities (and can encourage, assist, or require their suppliers to use such systems). Strategic energy management can help overcome organizational and institutional barriers to efficiency initiatives. The software solutions can not only monitor and optimize the performance and efficiency of buildings and equipment but also help companies track how their energy use changes over time. Air Products and Chemicals’ 2018 sustainability report discusses the benefits of using the International Organization for Standardization (ISO) 50001 strategic energy management standard to provide a consistent approach to managing energy use. The company has implemented ISO 50001 in Spain, Germany, and most recently, France.

TRANSPORTATION AND DISTRIBUTION

Companies that have international supply chains and widespread distribution networks, and companies that provide related services as part of their business, often discuss transportation and distribution in sustainability reports. For most companies, these manifest as Scope 3 reductions. Airlines, delivery companies, and consumer-facing businesses that own large vehicle fleets address these issues to reduce Scope 1 emissions and reduce operational costs.

A common approach to increasing the efficiency of transportation and distribution is to use more efficient vehicles. The United Parcel Service (UPS) uses alternative fuels for its ground transportation fleet as one strategy to meet its absolute GHG emissions target. As of its 2017 sustainability report, UPS had over 9,000 alternative fuel vehicles that ran on renewable natural gas, biodiesel, ethanol, batteries, or fuel cells.

Another approach to increasing transportation and distribution efficiency is to optimize distribution systems. Some companies have redesigned their packaging to reduce weight. Others have altered their logistical strategy to reduce shipping. Biogen highlights an initiative it started in 2016 that optimized shipments of goods that require refrigeration. Redesigned packaging is expected to reduce the cumulative weight, energy use, and associated emissions and reduce shipping costs by 30 percent.36

Ryder System, Inc. offers transportation and supply-chain management services and products that result in high downstream Scope 3 emissions from vehicles it leases out. Its 2017/2018 corporate sustainability report calls out its participation in the U.S. EPA SmartWay Partnership to demonstrate its commitment to tracking and reducing these emissions.

SUPPLIER ENGAGEMENT (CODES, PLEDGES, AND TRANSPARENCY)

Companies that rely on their suppliers for energy-intensive goods and services may focus their corporate sustainability efforts upstream, engaging with suppliers. Often suppliers can apply the same energy-saving measures as the company, but suppliers may be smaller and in countries with less-stringent energy efficiency requirements than the United States. One of the unique approaches that VF Corporation, an apparel company, mentions in its 2016 sustainability report is providing funding for its strategic supplier factories to update and improve their factory equipment. VF helped thirteen suppliers save 35 million kWh, 19,104 MT CO2e, 96,650 cubic meters of water, and more than $2.2 million during 2015–17 through their efficiency projects. The Walmart Factory Energy Efficiency Program has served over 800 factories in China, saving more than $440 million in operating costs and 270,000 MT CO2e.

Many companies require their suppliers to adhere to a code of conduct or sign a sustainability pledge, a sign of commitment in sustainability reports. A few have specific requirements, such as implementing an energy management system or developing a plan for energy efficiency. The Microsoft Supplier Code of Conduct sets expectations for companies with which Microsoft does business, mostly self-monitored. This code requires compliance with all applicable environmental laws and regulations and encourages the reduction of waste, including energy. Target’s standards of vendor engagement go a step further and require suppliers to identify all applicable energy sources and energy consumption, periodically to set goals to improve energy efficiency, and to document progress.

To measure their upstream energy use and Scope 3 emissions, some companies require transparency from their suppliers. Providing quantitative examples of energy and cost savings or emissions reductions resulting from corporate engagement with suppliers also is a popular way to highlight the effectiveness of energy efficiency. Dell Technologies requires 95 percent of direct materials suppliers not only to set specific emissions reduction targets and report on their emissions inventory but also to publish sustainability reports according to GRI or an equivalent global framework standard. Walmart committed to purchasing 70 percent of applicable U.S. goods from suppliers that participate in its Sustainability Index, accounting for over $200 billion in sales.

PRODUCT END USE

For some products, the energy use and emissions—and potential savings—are much greater from product use than from manufacture. Discussing these features in sustainability reports allows companies to showcase their attention to their customers’ wants and needs.

Vehicle manufacturers are acutely aware of this issue. John Deere highlighted its 8400R series tractors for increasing “fluid economy” and reducing GHG emissions. It also mentioned the energy savings and environmental benefits from products with improvements in extended life, reduced machine weight, and ecomodes.

Consumer technology companies know that their consumers want products with a long battery life as well as green products. By reducing the energy their products use, companies can address their consumers’ needs while reducing Scope 3 emissions. Apple has continually reduced the energy consumed by its products through better displays and more efficient power supply designs, achieving a 68 percent reduction in average energy use since 2008. Products that save energy will save consumers money. Home Depot set a goal to help its customers save $2.7 billion in energy costs by 2020; in 2018, it sold 231 million Energy Star products, and it estimated that those products reduced emissions by 7 million MT CO2e and that its customers saved $1.2 billion in energy costs.

Some companies make and sell products that enable energy efficiency. The environmental benefits resulting from products can contribute to a company’s “handprint,” but it is difficult to quantify such benefits. In its 2017 sustainability report, Praxair, an industrial gas company, claims the use of its atmospheric and process gases to make window insulation, coatings, and other products saved twice as many GHG emissions as the company emitted from its operations. While it makes sense to try to measure and increase such benefits, they should not be a substitute for more direct savings.

ACCOUNTING AND ACCOUNTABILITY: ENERGY EFFICIENCY IN OTHER CORPORATE REPORTING

Besides corporate sustainability reports, companies provide information on their sustainability goals and actions in a variety of forums. Much of the information is aimed at large investors such as state pension funds (and organizations that represent them), which have become increasingly focused on the financial risks from causing environmental damage, from the effects of climate change, and from shifting government policies. In some cases, investors also are driven by environmental values. They want companies to report on their sustainability records and related financial risks, and they seek to push companies to mitigate these risks and increase their actions on climate change.

CDP collects information from thousands of companies worldwide as well as from local governments on environmental commitments and performance related to climate, water, and forests. The audience is primarily large investors, though some of the information is publicly available. Several questions in its survey include energy efficiency targets, activities, and performance, but without common metrics or specific topics.

The international Financial Stability Board set up the Task Force on Climate Related Financial Disclosures (TCFD) to create broad guidelines on how companies should disclose climate-related risks and opportunities, with themes of governance, strategy, risk management, and metrics and targets. CDP and some other reporting vehicles are trying to align their surveys with TCFD’s recommendations. The broad 2017 principles only briefly mention energy efficiency, but the increased financial reporting on climate issues often includes efficiency.

The US-based Sustainable Accounting Standards Board (SASB) also focuses on financially material sustainability information in mandatory financial disclosures. SASB has worked with companies and other stakeholders to develop detailed and prescriptive 2018 disclosure standards for 79 industry sectors. For some but not all of those sectors, the standards include energy efficiency metrics. The Chemical Industry Standard, for example, requires reporting entities to disclose electricity use and total energy use and to discuss efforts to reduce energy consumption and improve efficiency in manufacturing and production processes, including implementing one of the green chemistry principles: design for energy efficiency. The standard also requires companies to disclose revenue from products designed to increase energy and other resource efficiency during their use. Companies can choose to follow the standards in required Securities and Exchange Commission 10-K or similar filings or in annual reports.

Many environmental, social, and corporate governance (referred to as ESG) ratings are available for companies, including by Sustainalytics (used by Morningstar), MSCI, and RobecoSAM (used by Dow Jones and S&P indices). These ratings often focus on financial risk and materiality and often use questionnaires and other available information. Energy efficiency and green buildings may factor into the ratings, but the specific criteria usually are not transparent, and the ratings often are not public. CDP also scores companies that report to them on climate (as well as on their other reporting focuses), giving grades from A to F. The scores cover climate-related opportunities and initiatives, including those focused on energy efficiency, based on whether the companies answered survey questions (but efficiency targets are not scored).

CONCLUSION

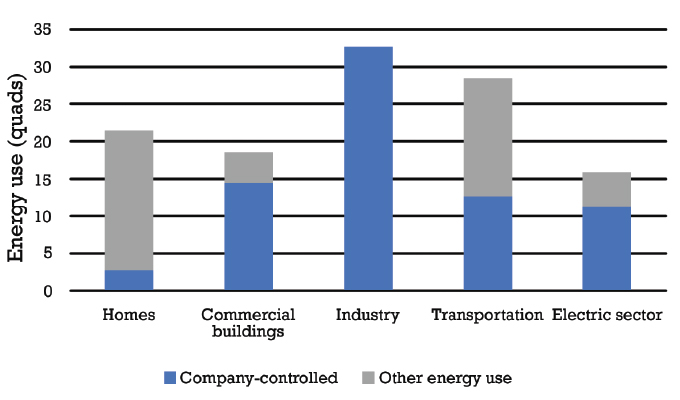

Companies should make energy efficiency the foundation of their commitment to addressing climate change because it can yield large reductions in GHG emissions while providing energy cost savings and other benefits. Companies control three-fourths of U.S. energy use and related emissions, and they have vast demonstrated opportunities to save energy, reduce energy bills, and cut emissions. These energy savings form a large part of the major reductions needed to avoid catastrophic climate change.

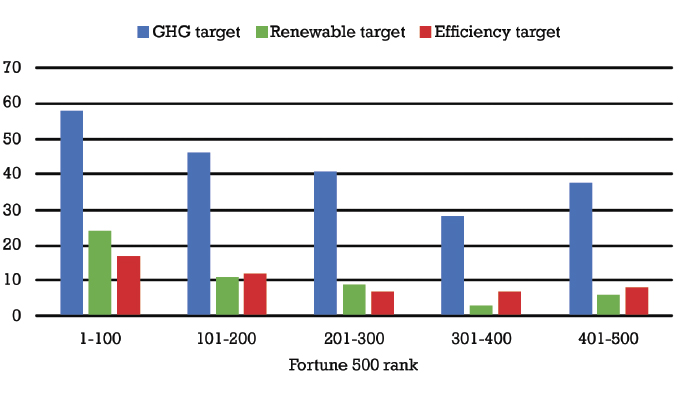

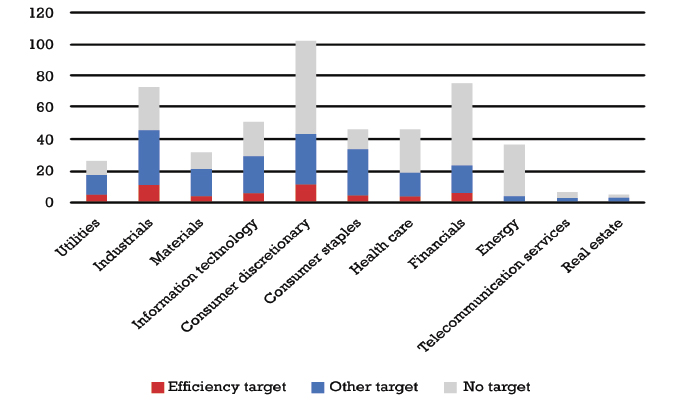

Many large companies set goals for reducing their emissions and report on progress in doing so. While energy efficiency may not make the cover of their sustainability reports, we found that every one of a sample of reports mentioned efficiency. The reports describe a wide variety of energy efficiency measures with a wide range of ambition using a wide range of reporting approaches and metrics. Significant efforts to encourage and systematize discussion of sustainability, including energy efficiency, in financial reports are too new to judge their success. Fewer companies set explicit goals for using efficiency to achieve sustainability; our literature review and analysis of corporate sustainability reports suggest that well under half of large companies have explicit energy efficiency targets. Without a target, the companies may lack focus on potential savings and have difficulty tracking progress.

To reap the potential savings from efficiency, companies should:

- Set specific energy efficiency or energy intensity targets consistent with broader sustainability goals, including science-based GHG targets; company-adopted efficiency targets can focus management attention, enable access to capital, and help overcome internal barriers

- Identify and pursue efficiency opportunities in buildings and plants, transportation systems, supplier networks, and end-use products to maximize savings

- Set up ongoing strategic energy management and energy management systems to enable continuous savings

- Report on efficiency measures, overall energy and efficiency trends, and progress in reaching the targets, as well as on how they affect the company’s financial risks and opportunities from climate change; transparency and accountability will allow financial markets to value efficiency initiatives

While many companies are pursuing some of these steps, few are embracing all of them. Most companies could achieve far greater savings by creating and implementing truly comprehensive efficiency strategies.

Reporting organizations and investors should also improve transparency and accountability by requiring companies to disclose energy efficiency information using standardized metrics, which often will vary by industry. They should also compile reported information from companies by industry to put the companies’ efforts in context. Organizations and investors can also help by consolidating sustainability reporting so that companies do not have to waste resources reporting in different formats and using different metrics.

With ambitious targets, clear reporting, and sustained management support, companies can make energy efficiency a central strategy for saving money and for meeting their climate commitments and the world’s climate needs.

FOR MORE INFORMATION

The American Council for an Energy-Efficient Economy (ACEEE), a nonprofit, 501(c)(3) organization, acts as a catalyst to advance energy efficiency policies, programs, technologies, investments, and behaviors. We believe that the United States can harness the full potential of energy efficiency to achieve greater economic prosperity, energy security, and environmental protection for all its people. For more information, visit www.aceee.org.

MODERN PUMPING TODAY, February 2020

Did you enjoy this article?

Subscribe to the FREE Digital Edition of Modern Pumping Today Magazine!