Miss part 1? Read it here.

As we explained in the first part of this series, combined cycle power plants (CCPPs) are becoming a larger portion of the power generation sector as renewables continue to be introduced as part of the North American energy grid. This has necessitated a more flexible approach to asset utilization than power producers of the past had to face.

Below, we’ll explore how CCPP operating models are changing to accommodate this rise in renewables and how this energy resource mix necessitates the inclusion of ancillary services to better manage the grid as operators transition to reduced or eliminated carbon footprints.

THE IMPACT OF RENEWABLES ON CCPP OPERATING MODELS

These trends are affecting power plants in both regulated and deregulated markets. In the regulated U.S. Southeast market, for example, there is limited wind potential and as solar energy increases in the region’s energy mix, producers must balance supply and demand: overgeneration during the day while the sun is shining, versus rising demand as the sun is setting with solar-generated power exiting the grid.

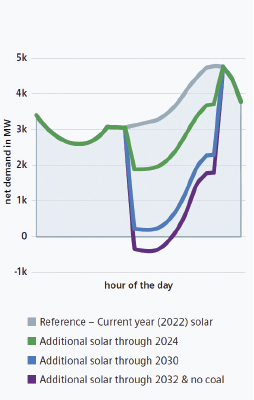

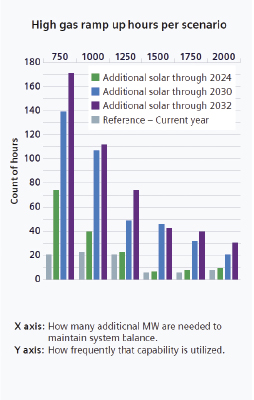

Figure 3 illustrates the expected deepening of the daily net demand ramp-rate curve (“Duck Curve”), a trend that while typically associated with California is now also projected in parts of the Southeast (shown in the figure for a regulated utility), through the anticipated growth in solar capacity by 2032.

What is less commonly understood is how soon CCPPs and others will need to increase their operational flexibility and be capable of high ramp rates. Figure 4 illustrates how soon and how often system resource planning teams rely on this level of flexibility to maintain grid stability.

In deregulated power markets, plants are dispatched based on the offers they submit to the market and the demand of the market. Typically, the most profitable periods are now concentrated during the evening although weather temperature extremes can cause spikes in demand, which can offer additional profit opportunities.

As a result, CCPP operators may need to stay online during low-priced hours despite having negative margins so they can collect the offsetting and more profitable margins the market’s higher priced periods offer. This operating model may create losses for the plant during hours when renewable overgeneration occurs and available prices for power are negligible.

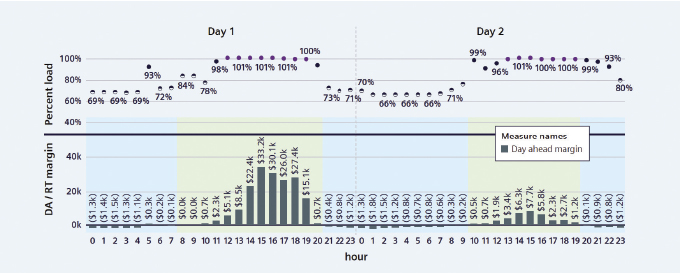

One measure CCPP producers can implement to help reduce these potential losses and help increase margins is to lower their minimum capacities during unprofitable hours. For example, as shown in figure 5, a Southcentral CCPP runs at a 69 percent load during non-profitable hours and ramps up its power production to 100 percent during high-margin periods including sub-hourly peaks in the real time market.

This strategy could help reduce the plant’s costs and losses during low-demand hours while also helping it to capitalize on the higher profit margins available during peak-priced periods, potentially boosting daily earnings. Improved cost structures could increase the likelihood of flexible plants being called on days with marginal demand as well as potentially capturing higher prices during real-time market surges.

THE GROWING ROLE OF ANCILLARY SERVICES

As the proportion of renewables grows in the North American energy resource mix, their inherent intermittency and resulting variability impacts grid stability and reliability as well as frequency control. In response, ISOs/RTOs are looking to ancillary services to better manage the grid during the transition to lower-carbon and net-zero resources.

ERCOT (Electric Reliability Council of Texas), for example, announced the ERCOT Contingency Reserve Service (ECRS) in June 2023. As a daily procured ancillary service supporting ERCOT’s reliability-first model for grid operations, it is intended to address growing energy demands in Texas, mitigating real-time operational issues to keep supply and demand balanced in order to help improve grid stability.

According to ERCOT, ECRS provides “capacity that can respond within ten minutes to address forecasting errors or to replace deployed reserves.” ECRS will backstop four other procured ancillary services ERCOT buys in the day-ahead market to balance the next day’s forecasted supply and demand of grid electricity. The debut of ECRS could portend initiatives by other ISOs / RTOs to enhance the ancillary services they use to maintain grid stability and reliability. Overall, the energy transition is expected to drive substantial growth in the use of ancillary services across North America. The U.S. power ancillary service market—led by the frequency controlled ancillary services segment—is estimated to have been worth $6.1 billion in 2022, with a 6.14 percent compound annual growth rate through 2028.

FROM BASE TO CYCLING OPERATION MODELS

Given the continued growth of renewables, today’s need for operational flexibility will likely increase well into the future. Operators can help address these challenges by accelerating plant ramp rates to improve plant responsiveness to higher-margin pricing opportunities.

CCPPs that are either currently transitioning or anticipating a shift from base load to cyclical operation will likely need to adapt their generating assets to meet these evolving operational requirements. A detailed plant and process analysis, such as a Technical Plant Assessment, is the first step CCPP producers should consider. This in-depth, end-to-end evaluation of a producer’s CCPP configuration, operations, and steam / water process can help identify, quantify, and prioritize improvement opportunities.

A LOOK AHEAD

In the finale of this series, we’ll walk through some of the improvement opportunities that operators are already incorporating with success as well as some just over the horizon. As you’ll see, for those CCPPs making the transition well, this leads to increased power outputs and operating efficiencies, faster starts and shutdowns, improved load ramp gradient, low-load operation, and expanded operating ranges.

Located in ninety countries, Siemens Energy operates across the whole energy landscape—from conventional to renewable power, from grid technology to storage to electrifying complex industrial processes. For more than 150 years our engineers have been spearheading the electrification of the world. Today, we are a team of 99.000 sharing the same passion, vision, and values. Our diversity makes us strong and helps us to find answers together with our partners. For more information, visit www.siemens-energy.com.