As renewables grow in the energy mix used by North American power producers, keeping generating assets best utilized requires operating them with a flexibility that often exceeds the original capabilities of most plants today. Combined cycle power producers need to get into markets fast—when prices are high – and get out fast, when margins may be low or even negative.

Given the steady growth of renewables in the North American energy mix, volatile fuel prices, and current and proposed governmental legislation, the operational profiles of combined cycle power plants (CCPPs) are dramatically changing from base load to cyclical modes. In addition, ancillary services are playing a growing role in helping to ensure grid reliability and accommodate an energy resource mix that will continue evolving with more renewables.

These trends affect both regulated and unregulated markets. They require power producers to have more flexibility in their asset utilization in order to meet revenue goals, expand operating margins, and maintain profitability. How fast and reliably they can exercise that flexibility is critical, too.

CCPP operators must not only generate power as efficiently as possible but also have their plants ready to ramp whenever power markets are paying premium prices. Increasing plant operational flexibility can help operators both minimize generation costs during times of low power prices and help capture the margins peak prices offer.

This paper focuses on measures intended to optimize CCPP operational flexibility for North American producers. It explains new operational profiles due to the energy transition, which make enhanced startup and shutdown processes necessary. These include optimized hot, warm, and cold starts, as well as improved ramp-up / ramp-down load gradients.

RENEWABLES COMPLICATE PROFITABILITY

Among the 3,000 utilities operating in the United States and the sixteen major utilities operating in Canada, no two are alike. Each serves customers of all kinds, from household consumers to heavy industries. They can span different regional geographies with wide variations in seasonal demands, which can change dramatically from year to year.

Their energy sources can vary widely, too, as can the age and composition of their generating capacity. Additionally, individual operators must comply with ever-changing federal and state environmental requirements, and regulated producers must abide by strict tariff structures.

Finally, there are myriad other operating variables that can potentially affect a utility’s margins and, ultimately, its profitability.

CHALLENGES TO A DECARBONIZED ENERGY FUTURE

All North American utilities and independent power producers face one common challenge: the rapid growth of renewables in the power-generation mix as the power industry continues moving toward a de-carbonized energy future.

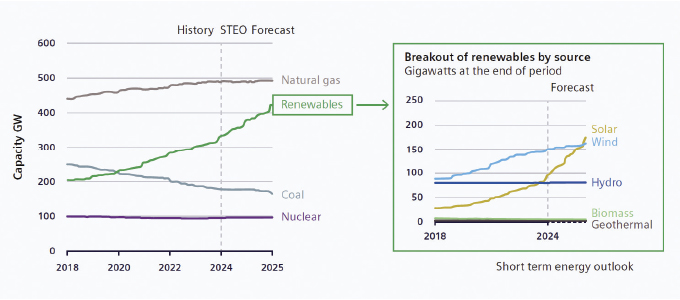

In 2023, renewable energy sources—wind, solar, and hydro, chief among them—accounted for 22 percent of generation. From those sources, new solar projects coming online in the near-term are expected to propel solar’s growth 75 percent by 2025 while wind will grow 11 percent in that same time period. Looking even further ahead to 2050, solar and wind generation is forecast to provide the energy for between 55 and 85 percent of total U.S. power generation.

Figure 1 illustrates the forecasted U.S. power-generating mix through 2025, showing solar overtaking wind and both eclipsing coal and nuclear combined.

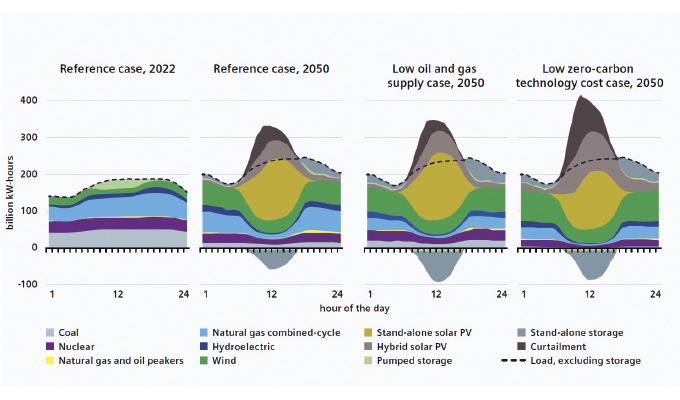

Figure 2 illustrates different forecast scenarios by 2050 for hourly U.S. electricity generation and load by fuel for selected cases and representative years, according to the U.S. Energy Information Administration. Of course, 2050 holds much uncertainty in how these scenarios will unfold, but all scenarios clearly show the diminished role of coal compared to the fuel mix behind power generation in today’s grid. Across all long-term scenarios, the gas fleet remains essential for reliable grid operation although the operational profile evolves significantly.

In fact, coal’s anticipated exit from today’s grid by 2030 is straining the remaining dispatchable resources, particularly the natural gas turbine fleet, which will be ever more challenged to balance increasing electrical demand and increasingly variable supply.

Asking more from today’s fleet creates an opportunity for plant owners to position their assets optimally for their future usage profile so they can potentially maximize both their utilization of those assets and their operating margins.

These described trends are manifesting themselves in today’s grid in specific seasonal patterns. This evolution is expected to grow in frequency and magnitude throughout the country over time.

OPERATIONAL FLEXIBILITY’S IMPACT ON PROFITABILITY

While rapidly falling prices of solar and wind technologies per kilowatt have spurred the growth of their adoption in recent years, renewables have secured government funding incentives to expand their deployments even more.

The U.S. Inflation Reduction Act (IRA) of 2022 offers $370 billion in tax credits to boost the nation’s use of renewable energy. Some industry observers estimate these credits will triple the amount of utility-scale green power in the United States. from today’s levels to approximately 750 GW by 2030. While investment tax credits were primary motivators heretofore, the addition of production tax credits may accelerate solar’s development even more.

This rapid expansion of renewables will likely require upgrades to North America’s grid, including ISO / RTO interconnections. At the same time, the variability caused by the intermittency of renewables means power producers who can become more flexible in how they operate their generating assets from day to day and season to season can improve business outcomes.

Indeed, utilities are already taking action. Factors such as power price variability, increased emission requirements affecting fossil power, and new market mechanisms are driving a shift in the operating profiles of CCPP assets from base load to flexible cycling modes. To adapt, CCPP assets may need to enhance their operational flexibility through improved start-up and shut-down times, higher load gradients, and other asset optimization concepts.

A LOOK AHEAD

In upcoming installments in the series, we’ll explore different operational concepts and how they influence the bottom line. As we’ll see, the core principles for these operational flexibility improvement concepts can be adapted to different sectors and pay off over time.

Located in ninety countries, Siemens Energy operates across the whole energy landscape—from conventional to renewable power, from grid technology to storage to electrifying complex industrial processes. For more than 150 years our engineers have been spearheading the electrification of the world. Today, we are a team of 99.000 sharing the same passion, vision, and values. Our diversity makes us strong and helps us to find answers together with our partners. For more information, visit www.siemens-energy.com.