Conventional oil and gas discoveries during the past three years are at the lowest levels in seven decades and a significant rebound is not expected, according to a new report by global business information provider IHS Markit. The report, entitled “IHS Markit Conventional Exploration Results in Early 2018 Through 2019: No Rebound in Activity or Results,” says that these trends have far-reaching implications that could limit future conventional reserves additions. Below, the report’s lead author, Keith King, explains what this can mean for investors and the industry.

MPT: What does the new IHS Markit report identify as driving changes in oil and gas exploration?

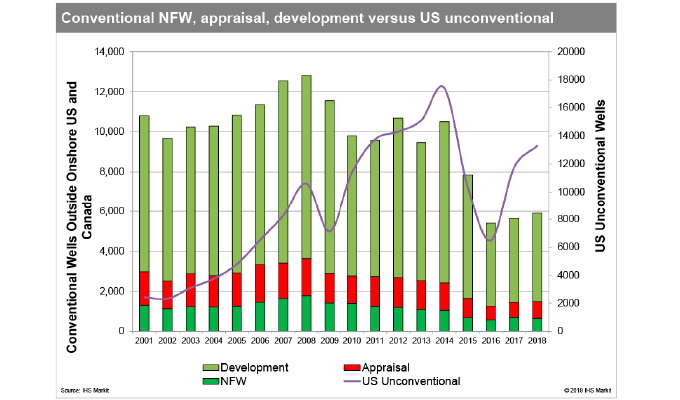

Keith King:The low levels in discoveries come as a result of a pullback during the past ten years in the wildcat drilling that targets conventional oil and gas plays—most drastically after oil prices collapsed in 2014.

The decline in conventional discoveries was not only driven by low oil prices, but by competition from short cycle-time unconventional projects, and by financial investors who question long-term, high-cost, frontier projects. These factors, in turn, shifted drilling away from areas where potential discoveries could be larger, and reduced upstream exploration investment due to concerns about long-term oil demand.

MPT: What projects do appear to be attracting interest?

Keith King: One of the main drivers here is the shift of investment by U.S. independents from international exploration to shale opportunities in the United States—shorter cycle-time projects—with greater flexibility to respond to changing market conditions. These operators can quickly turn an unconventional project off and stop or postpone drilling next month if oil prices fall.

In addition to the overall reduction in conventional drilling, we identified additional reasons for the modest exploration results in recent years. One of the most telling is that the average discovery size of conventional fields varies greatly with the maturity of the basins being explored.

MPT: What connections did you find between basin maturity and discovery size?

Keith King: Basins that are early in their life cycle—the frontier and emerging phases—have average discovery sizes ten times greater than average discovery sizes made in the later, more mature basins. The average discovery size of these early life-cycle basins is approximately 210 million barrels versus 25 million barrels from mature basins discovered during the last ten years.

MPT: Were there any other correlations the report found?

Keith King: The IHS Markit analysis also showed

differences between average discovery sizes in deep- and ultra-deep-water areas compared to shallow water and onshore discoveries—the former being five or more times greater on average.

Despite the larger discovery size associated with these deeper water and frontier/emerging basins, operators are drilling fewer wells in these areas. In 2014, 161 new field wildcats were drilled in deep and ultra-deep water; by 2018 that number dropped to sixty-eight wells. Drilling in frontier/emerging-phase basins declined by a similar amount.

MPT: How do you think this will play out for the oil and gas industry at large:

Keith King: The industry will likely continue to invest more in less costly, less risky, quicker cycle time projects in the onshore and shelf, with deep-water investment remaining constrained. There will be areas of intense activity in the deeper water depths and in frontier and emerging-phase basins as well, but overall, these areas will only see incremental gains.”

FOR MORE INFORMATION

Siemens Digital Industries Software, a business unit of Siemens Digital Industries, is a leading global provider of software solutions to drive the digital transformation of industry, creating new opportunities for manufacturers to realize innovation. With headquarters in Plano, Texas, and over 140,000 customers worldwide, we work with companies of all sizes to transform the way ideas come to life, the way products are realized, and the way products and assets in operation are used and understood. For more information, visit www.sw.siemens.com.

IHS Markit includes more than 5,000 analysts, data scientists, financial experts, and industry specialists. Its global information expertise spans numerous industries, including leading positions in finance, energy, and transportation. For more information, visit www.ihsmarkit.com.

MODERN PUMPING TODAY, October 2019

Did you enjoy this article?

Subscribe to the FREE Digital Edition of Modern Pumping Today Magazine!